AUGUST 2024 HOUSING MARKET UPDATE

Calgary housing market sees shifts Housing activity continues to move away from the extreme sellers’ market conditions experienced ...

READ POSTBlogging has not been my strength and so this is officially a work in progress. I have some big plans for the blogging page in the foreseeable future so I ask for your patience as I venture into this side.

Calgary housing market sees shifts Housing activity continues to move away from the extreme sellers’ market conditions experienced ...

READ POSTSupply levels improve, taking some pressure off prices With the busy spring market behind us, we are starting to see some shifts in ...

READ POSTCREB® releases Q2 2024 Calgary and region housing market report The Calgary Real Estate Board (CREB®) has released its Q2 2024 housing ...

READ POSTJune sales decline amid supply challenges and rising prices Sales in June reached 2,738, marking a 13 per cent decline from last year’s ...

READ POSTTimes Are Tough, But Finding Low-Cost Fun Shouldn't Be Here Are Things To Do This Month FOR FREE Legacy’s ...

Home safety for trick or treaters As a responsible homeowner, making your property safe for young trick-or-treaters ...

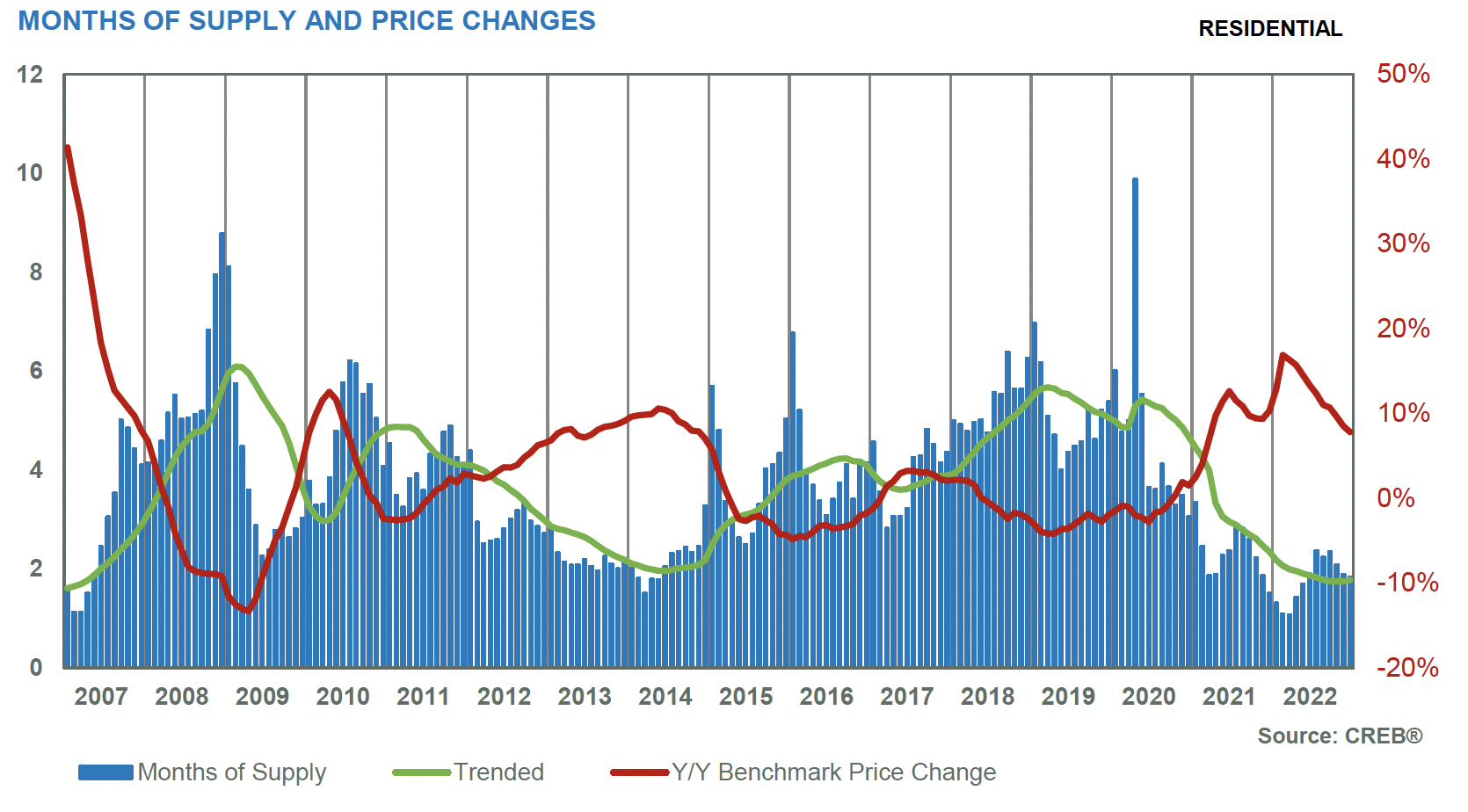

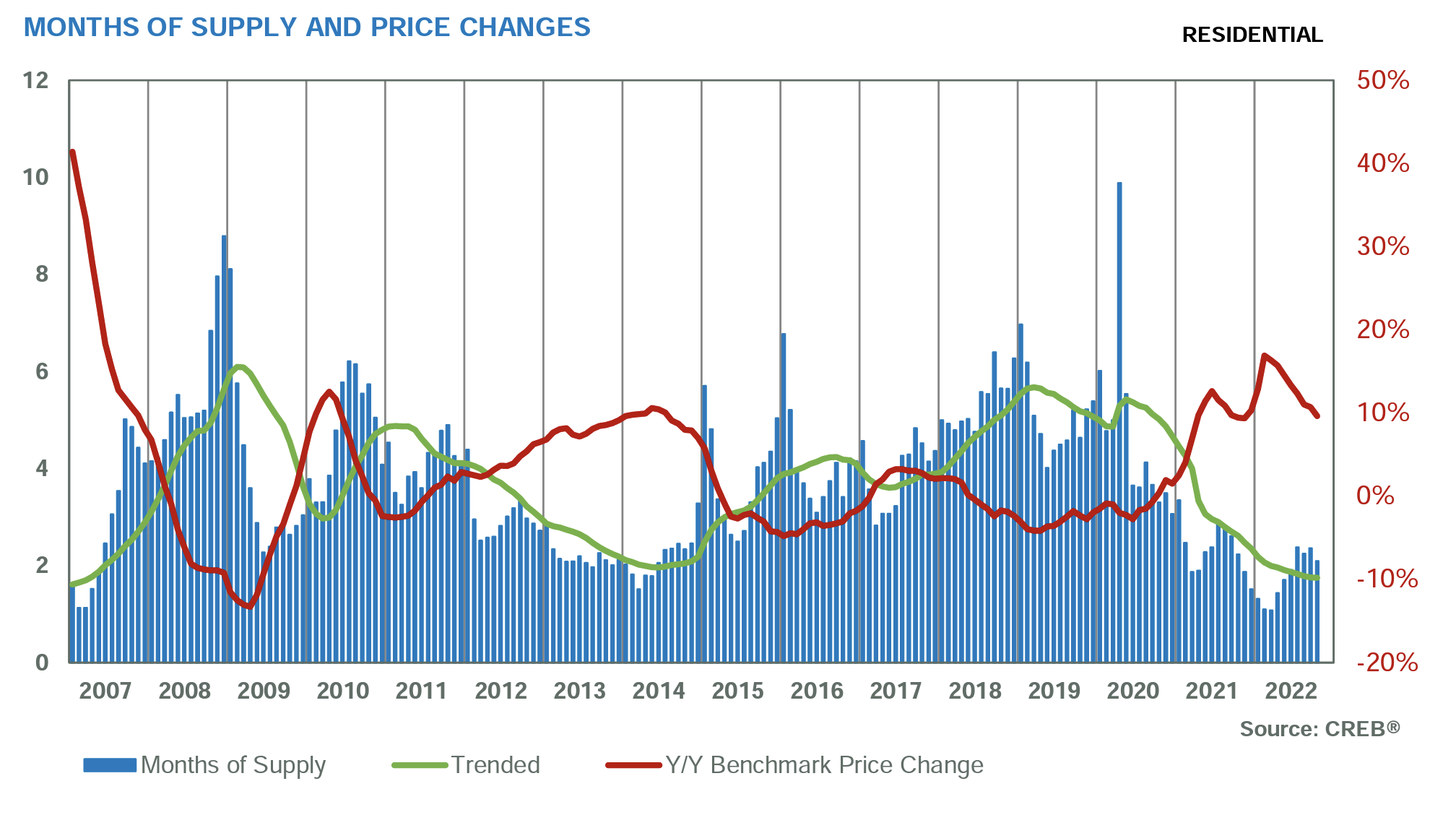

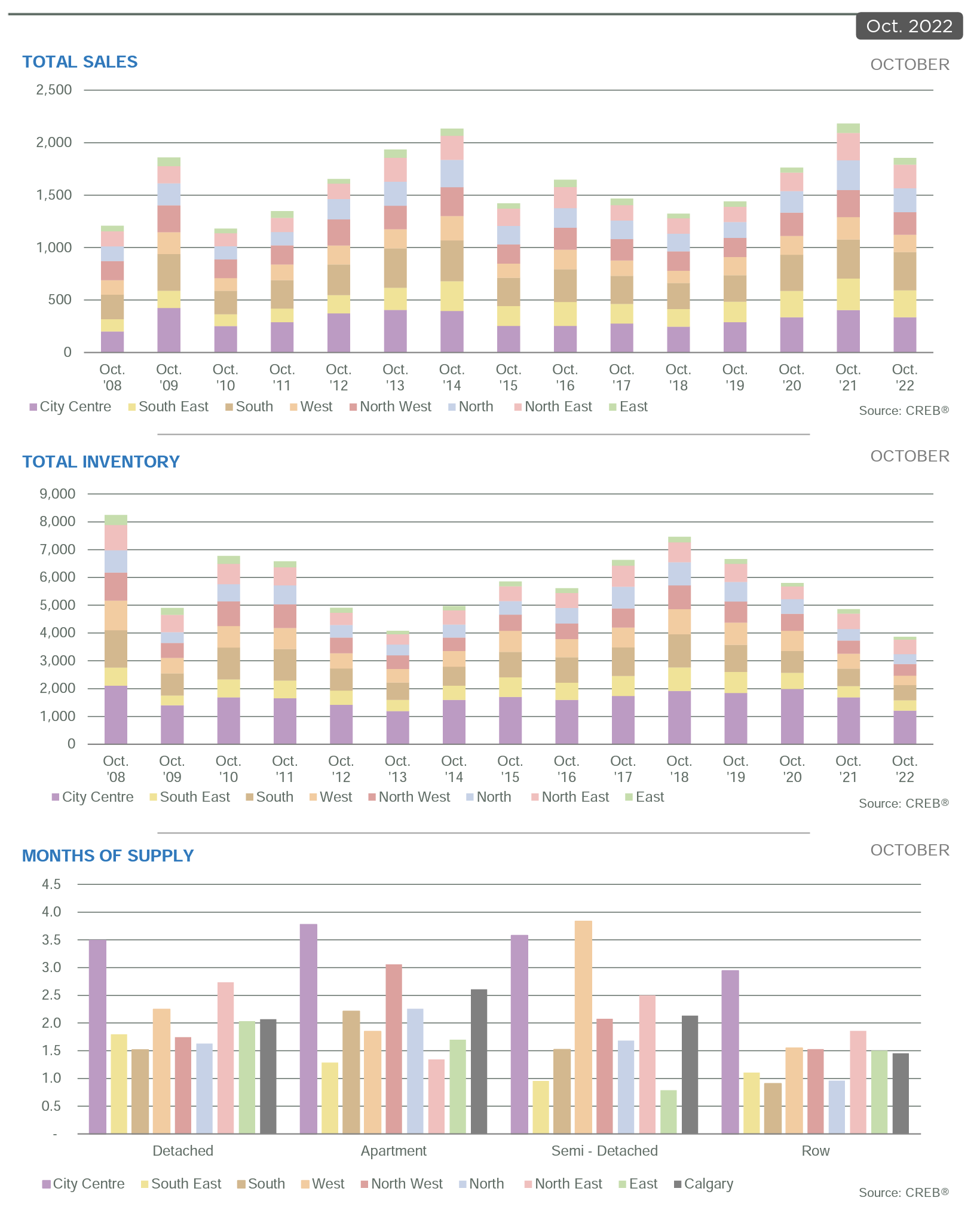

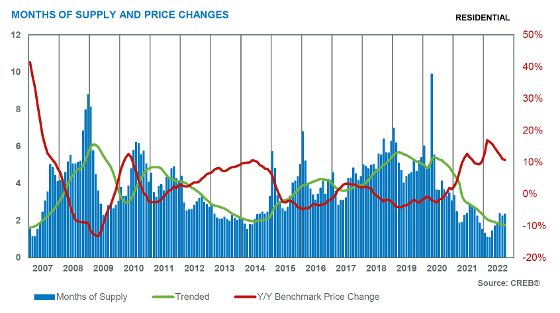

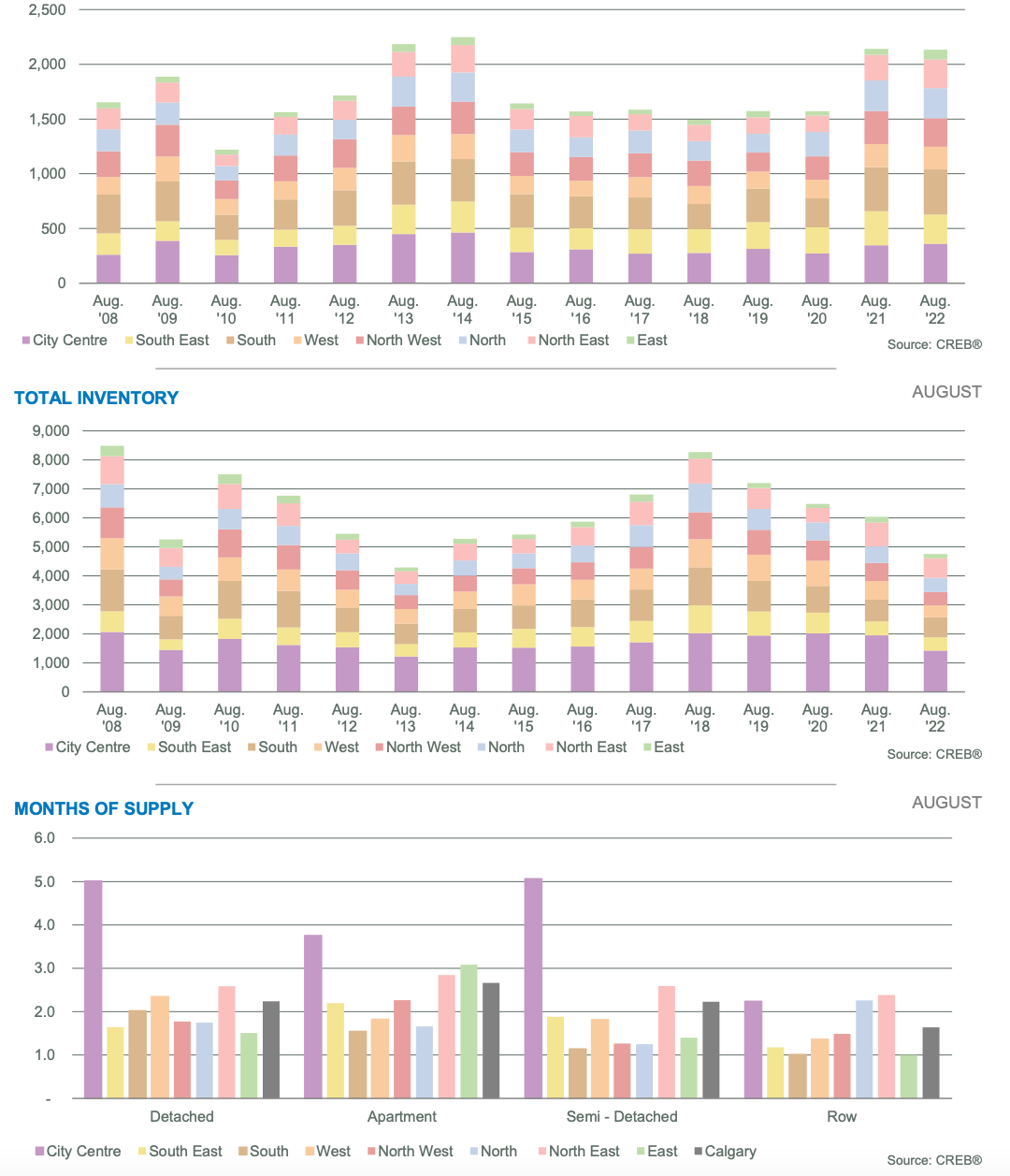

“Housing market conditions have changed significantly throughout the year, as sales activity slowed following steep rate gains throughout the later part of the year,” said CREB® Chief Economist Ann-Marie Lurie. “However, Calgary continues to report activity that is better than levels seen before the pandemic and higher than long-term trends for the city. At the same time, we have faced persistently low inventory levels, which have prevented a more significant adjustment in home prices this year.”

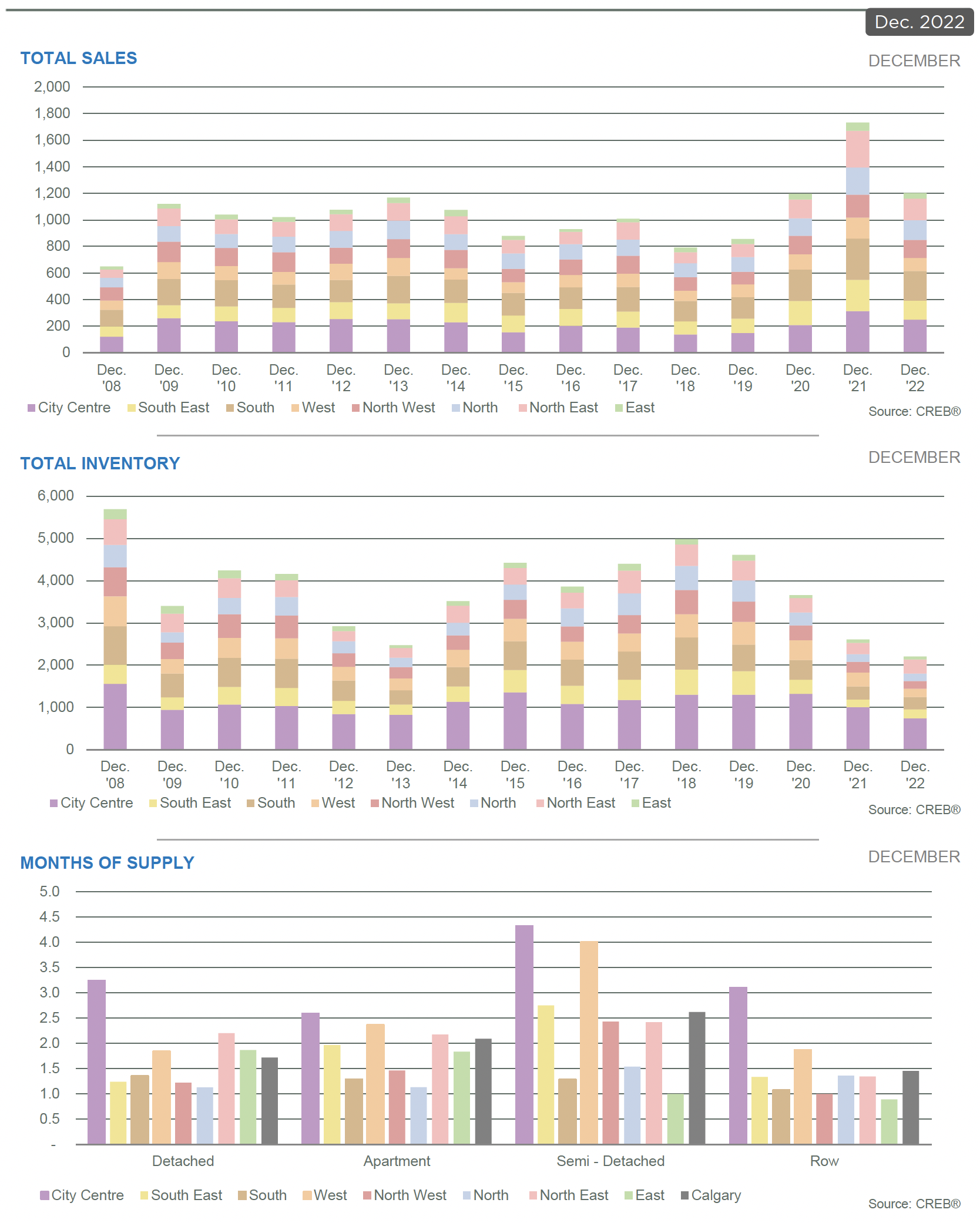

Residential sales in the city slowed to 1,648 units, a year-over-year decline of 22 per cent, but 12 per cent above the 10-year average.

The pullback in sales over the past six months was not enough to erase gains from earlier in the year as year-to-date sales remain nearly 10 per cent above last year’s record high. The year-to-date sales growth has been driven by a surge in both apartment condominium and row sales.

“Easing sales have been driven mostly by declines in the detached sector of the market,” said CREB® Chief Economist Ann-Marie Lurie. “Higher lending rates are impacting purchasers buying power and limited supply choice in the lower price ranges of the detached market is likely causing many purchasers to place buying decisions on hold.”

A decline in sales was met with a pullback in new listings and inventories fell to the lowest level reported in November since 2005. The pullback in both sales and new listings kept the months of supply relatively tight at below two months. The tightest conditions are occurring in the lower-price ranges as supply growth has mostly been driven by gains in the upper-end of the market.

November sales eased mostly due to the significant pullback in detached sales. While sales this month are down over last year’s record levels, overall activity is still far stronger than long-term trends and year-to-date sales are still on pace to reach a new record high.

New listings did improve over the previous year, thanks to gains in row, semi and apartment style product. While the growth in new listings did cause November inventories to rise over last year’s low levels, inventory levels remain nearly 40 per cent below long-term trends in the area.

Despite persistently tight conditions, benchmark prices continue to trend down from the record high level reported in April of this year. Despite some adjustments, prices remained over 13 per cent higher than last year’s levels.

Detached sales slowed across every price range this month, contributing to the year-over-year decline of nearly 34 per cent and the year-to-date decline of five per cent. On a year-to-date basis, sales have eased for homes priced under $500,000 as the level of new listings in this price range has dropped by over 36 per cent limiting the options for purchasers looking for affordable product.

Meanwhile, new listings and supply selection did improve for higher-priced properties creating more balanced conditions in the upper-end of the market. This has different implications on price pressure in the market.

The benchmark price in November slowed to $619,700, down from the high in May of $648,500. While prices have eased over the past several months, they continue to remain nearly 11 per cent higher than levels reported last year.

The pullback in sales this month was enough to cause the year-to-date sales to ease by nearly one per cent compared to last year. Despite the recent declines, year-to-date sales remain 37 per cent above long-term averages for the city.

Easing sales this month were also met with a pullback in new listings, causing further declines in inventory levels and ensuring market conditions remained relatively tight with a month of supply of two months and a sales-to-new-listings ratio of 100 per cent.

Unlike the detached sector, the tight conditions prevented any further retraction in prices this month. In November, the benchmark price reached $562,800, slightly higher than last month and nearly 10 per cent higher than last year’s levels.

Further declines in new listings likely contributed to the slower sales activity this month as the sales-to-new-listings ratio remained high at 99 per cent. Inventory levels fell to 383 units, making it the lowest level of November inventory recorded since the 2013. This low level of inventory ensured that the months of supply remained below two months.

Despite the persistently tight market conditions, prices trended down this month reaching $358,700. While prices have eased from the June high, they are nearly 14 per cent higher than prices reported last November. The strongest price growth was reported in the North East, North and South East districts where prices have risen by over 18 per cent.

Despite a pullback in new listings this month, apartment condominium sales continued to rise, and inventories fell to the lowest November levels seen since 2013. This caused further tightening in market conditions as the sales-to-new-listings ratio pushed above 100 per cent and a months of supply dropped to two months.

Recent tightening in the market has put a pause on price adjustments for apartment condominiums. In November, prices remained relatively stable at $277,000 compared to last month. While prices have reported a year-over-year gain of nearly 10 per cent, prices are still below their previous highs set back in 2014.

Further declines in November sales contributed to the six per cent year-to-date decline in sales. However, with 1,091 sales so far this year, this is still 69 per cent above long-term trends for the town.

Meanwhile, new listings have remained relatively low compared to sales, preventing a more significant shift in inventory levels. In November, inventory levels did rise above the low levels seen last year, but remained 35 per cent below longer term trends for the area.

Following significant gains reported earlier in the year, benchmark prices continue to trend down in November. However, the adjustments did not erase previous gains as the benchmark price remained over 12 per cent higher than levels reported last year.

Both sales and new listings eased in November preventing any significant change to inventory levels. While inventory levels are higher than last year, they remain 54 per cent below long-term trends for the area. Overall year-to-date sales activity has improved over last year and are 41 per cent higher than long-term trends.

As conditions have remained relatively tight this month, we saw a reversal of some of the price adjustments recorded over the previous two months. The benchmark price in November reached $549,100, a two per cent gain compared to last month, and a year-over-year gain of nearly 16 per cent.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Demand shifting to more affordable options

City of Calgary, October 3, 2022 –

Strong sales for condominium apartment and row properties were not enough to offset declines reported for other property types. This caused city sales to ease by nearly 12 per cent compared to last year.

However, with 1,901 sales in September, activity is still far stronger than levels achieved prior to the pandemic and is well above long-term trends for September. Despite recent pullbacks in sales, and thanks to strong levels earlier in the year, year-to-date sales remain 15 per cent higher than last year’s levels.

“While demand is easing, especially for higher priced detached and semi-detached product, purchasers are still active in the affordable segments of the market, cushioning much of the impact on sales,” said CREB® Chief Economist Ann-Marie Lurie. “At the same time, we are seeing new listings ease, preventing the market from becoming oversupplied and supporting more balanced conditions.”

In September, new listings declined by ten per cent. With a sales-to-new-listings ratio of 72 per cent, it was enough to prevent any gain in inventory levels, which declined over last month and were nearly 21 per cent lower than last year’s levels. The adjustments in both sales and supply levels have caused the months of supply to remain relatively low at less than three months.

The shift to more balanced conditions is causing some adjustments to home prices. While prices have slid from the highs seen in May, as of September, benchmark prices remain 11 per cent higher than last year and six per cent higher than levels reported at the beginning of the year.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

The interior design style known as Bauhaus is guided by the belief that materials should not be hidden behind upholstery but exposed to show the honesty of each piece.

This sparse, austere style can be recognised by its steel tubing designs of chairs, sofas and tables. It still looks incredible in modern houses and apartments, yet it rose out of a war-ravaged Germany from the 1920s.

Bauhaus elevated the skills of architecture, design and machinery and its design philosophy is around simplicity, economic logic and mass production

When you select Bauhaus as your interior design, you are embracing German history and culture that championed the beauty of industrialised, mass-produced furniture of light materials, geometric form and functionality.

Here are some tips for introducing a Bauhaus aesthetic to your home

The most fundamental of Bauhaus principles is that form follows function. Practically, this means that what looks good takes second place to practical use. For example, chairs with no discernible purpose are avoided even if one might look good in the corner of the room. This means no knick-knacks and ornaments.

Bauhaus deals faithfully with the materials of the furniture. Nothing should be hidden for the sake of aesthetics. Your home should expose the beams in the roof and make it integral to the furnishings, where the steel-tubing of chairs and tables is exposed as part of the ‘truth in materials’ philosophy.

Your entire approach must embrace the minimalist, industrial philosophy with the placement of furniture being linear. Avoid curves. Color, line and shape of furniture are the primary, almost the only, consideration in true Bauhaus design.

Bauhaus interior design inspired a new wave of German art in the early 1920s that can still be found today. The founder of the Bauhaus movement, Walter Gropius, warned against creating an empty carcass of a home and he encouraged the installation of select and powerful artwork. Everything you put in your house should embrace the overall concept of Bauhaus.

It may be the smallest room in the house, but the bathroom makes a big impact, especially with so many stunning options now available in tiling, baths and vanities.

A bathroom remodeling project can add thousands of dollars to a property and, at the same time, enhance family life. But some of the new luxury options can be a little impractical when they’re used regularly by kids.

It’s important to make great decisions that are affordable and add value to your home.

Here’s our guide to remodeling for a family-friendly bathroom that’s beautiful and practical.

A bath is essential, as every parent knows. It’s a great place to calm down the kids and get them ready for the evening and bedtime. Acrylic baths offer the best value and safer option than say, an iron bath. The new freestanding baths are the height of luxury, but with kids splashing everywhere, mess can quickly build up in hard-to-access corners. Get the best of both worlds by choosing the styles that look like they’re freestanding but actually fit flush to the wall.

Select an adjustable, detachable showerhead and hand shower to cater for every age group. It’s especially practical for washing hair and will allow you to ‘hose down’ kids on the occasions when they need it, like after a muddy sports day. Hand-helds also makes cleaning the shower easier because you can get into the corners and rinse off tiles properly.

No one enjoys scrubbing the bathroom. Reduce dust and mess build up around the S bend and awkward spots by choosing a unit that runs flush to the wall, or hangs from the wall. It will make cleaning so much easier. Also, choose a soft-closing seat to prevent it slamming down.

Make sure your vanity doesn’t have sharp edges. Avoid protruding basins as this reduces the risk of children bumping their heads. If you have space, consider installing a double vanity so there’s no fighting over the tap at teeth-brushing time. Vanity tops can be stained or scratched easily if you choose the wrong materials. Quartz and stone are high-end materials that are scratch-resistant and come in a variety of designs and colors. They’re better for high traffic and splash areas than say, timber. Glass for your shower recess and glossy porcelain tiles will maintain their original luster even with punishing usage.

Avoid the temptation to choose a white tiled floor. It will show dust, dirt and hair minutes after you’ve cleaned it. Go for a more beige or sandy color, or consider a texture that will make regular wear less noticeable. Make sure the floor tiling is non-slip. A good choice is mosaic tiling because its many grout lines offer greater grip. Tile to the ceiling if this is practical, especially behind the bath. That way the kids can splash to their hearts’ content, and you don’t have to worry about the paintwork.

Ask your bathroom designer about new devices that stop children from being scalded by hot water. A temperature-control feature in the bathroom will keep the children safe and be an asset if you wish to sell your home in the future. Easy-grip lever-handle taps can help avoid accidents, too, and they’re easier for kids to manage.

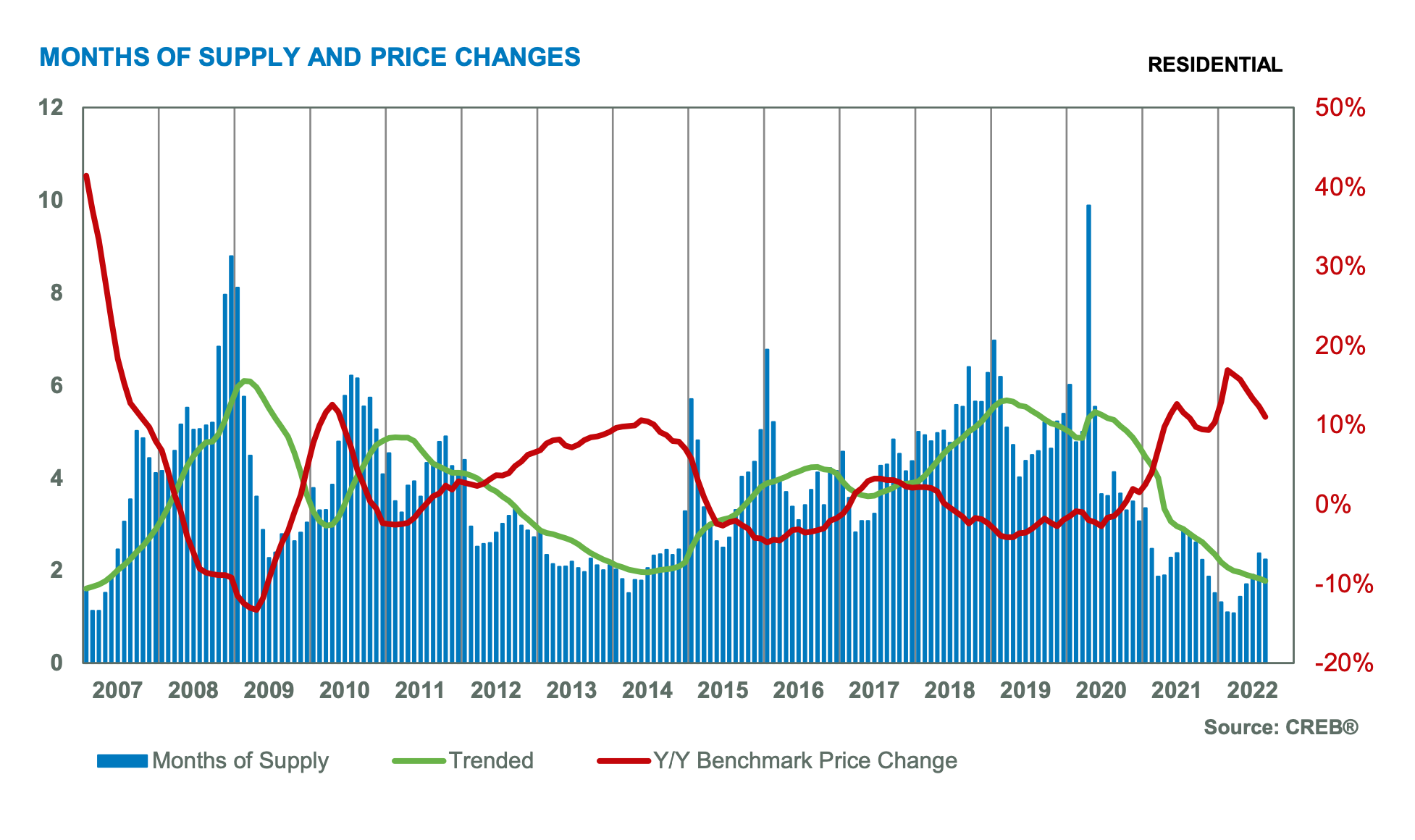

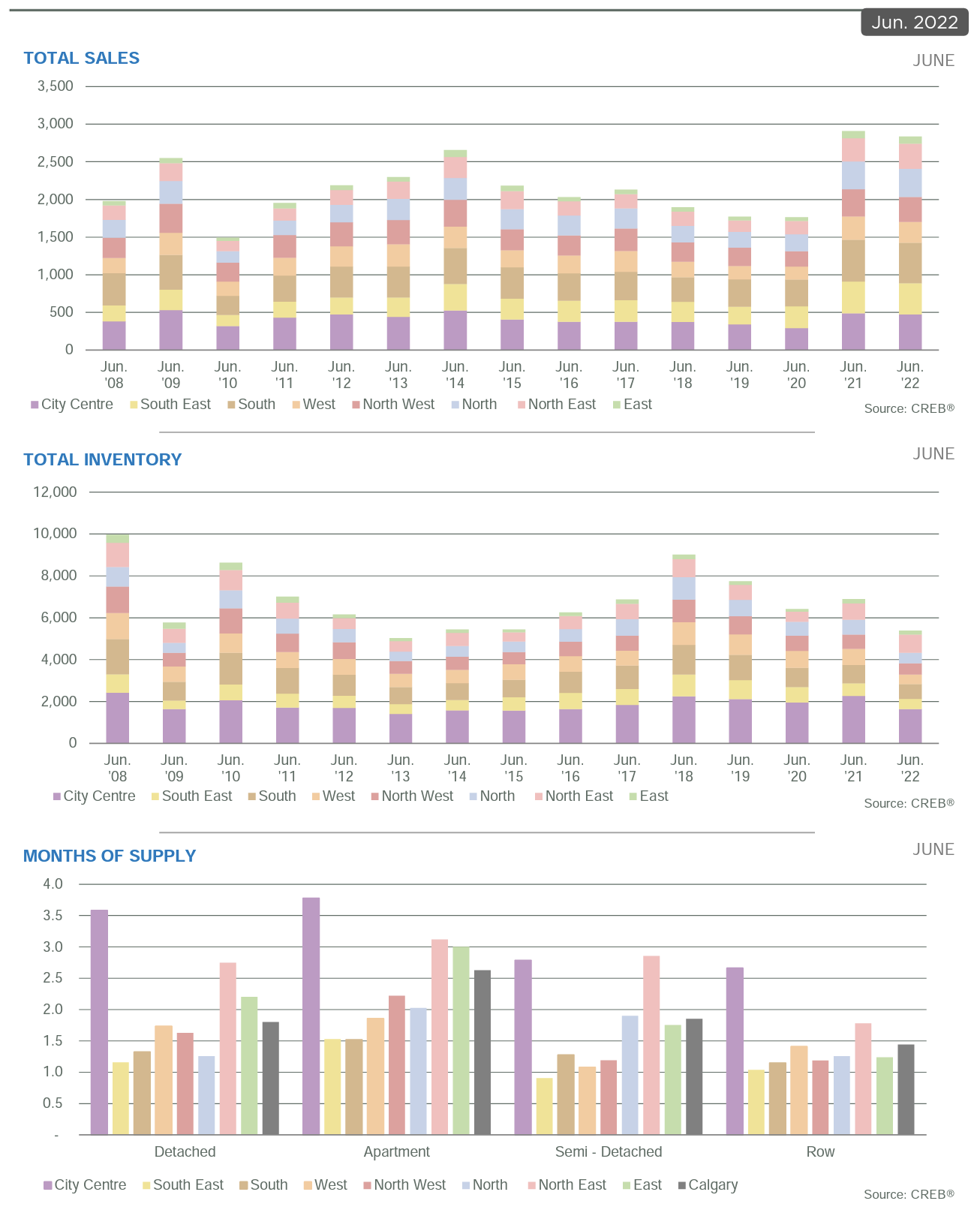

City of Calgary, July 4, 2022 – Sales activity in June eased relative to the past several months and with 2,842 sales, levels declined by two per cent over last year’s record high. While sales activity has remained relatively strong for June levels, the decline was driven by a pullback in detached and semi-detached home sales.

“As expected, higher interest rates are starting to have an impact on home sales. This is helping shift the market toward more balanced conditions and taking some of the pressure off prices,” said CREB® Chief Economist Ann-Marie Lurie.

“While we are starting to see some transition, it is important to note that in Calgary year-to-date sales are still at record levels and prices are still far above expectations for the year.”

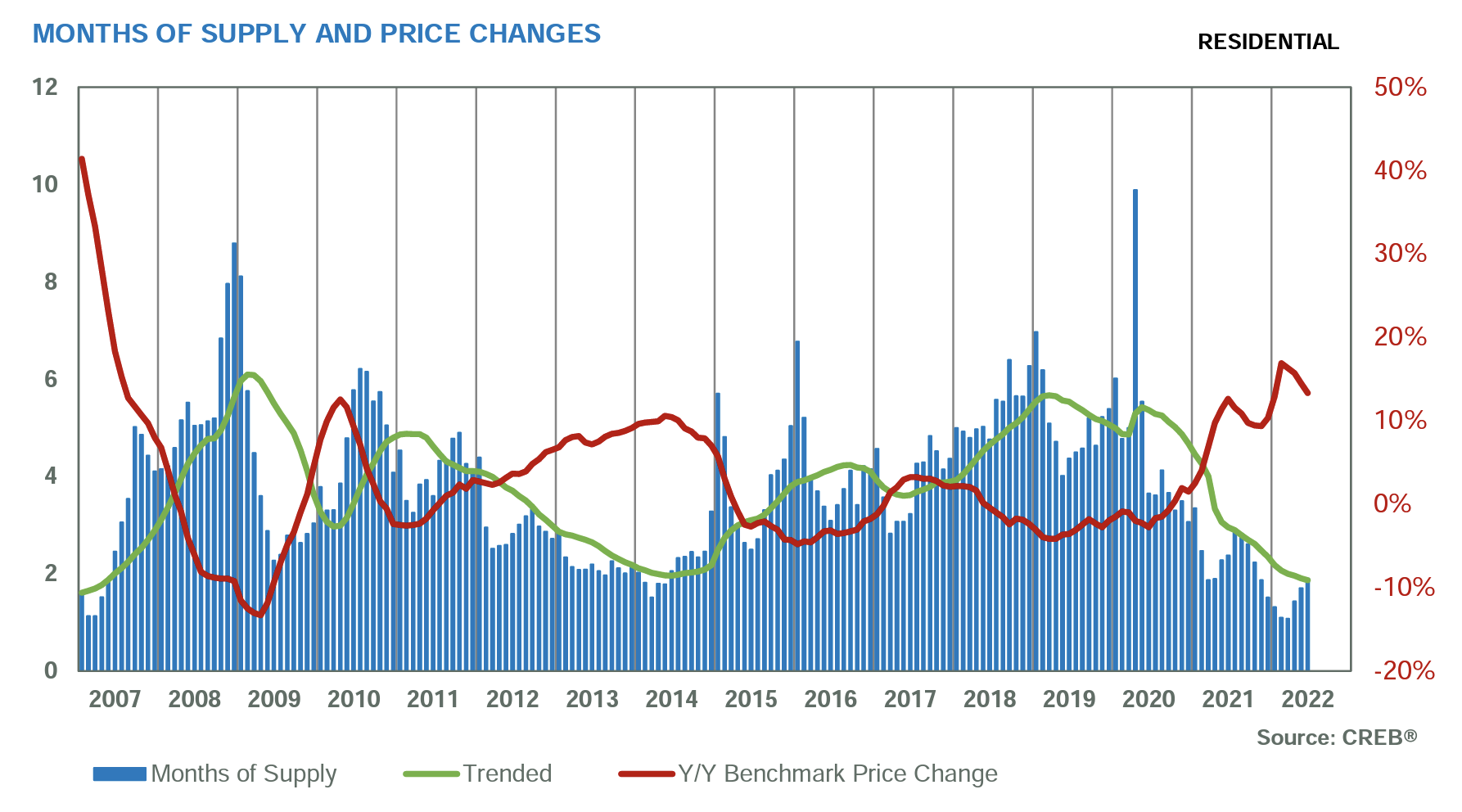

This pullback in sales was not met with the same level of pullback in new listings. This caused inventories to trend up over previous months. These shifts are supporting some easing from the exceptionally tight conditions as the months of supply remained just shy of two months. While two months is still considered low for our market, it is a significant change over the one month of supply recorded earlier in the year.

After three months of gradual gains in the months of supply, prices eased slightly relative to last month. However, with a city-wide benchmark price of $543,900, levels are still over 13 per cent higher than last year.

With further rate gains expected, we could continue to see slower sales activity and some monthly price growth slippage in the Calgary market in the coming months. However, thanks to renewed migration and job growth in a wide range of sectors, it is unlikely that we will see a full reversal of the price gains made so far this year.

For the third month in a row, sales levels in the detached market have eased. Much of the pullback has occurred from homes priced under $600,000. While some of this is likely related to the continued lack of supply choice, the pullback in this sector is also related to the rise in lending rates that are impacting qualifications levels and creating some hesitancy among consumers.

The pullback in sales relative to new listings did cause some modest gains in inventory levels compared to earlier in the year. This helped push up the months of supply to just under two months. The shift to more balanced conditions has been limiting the upward pressure on prices. As of June, the benchmark price was $647,500. This is comparable to last month, but still 16 per cent higher than last year.

Like the detached sector, sales activity slowed in June. While the pullback in sales was not enough to offset earlier gains, it was enough to push the months of supply up to nearly two months. While this gain in months of supply is likely welcome news for some buyers, conditions still remain tight compared to what we traditionally see in this segment of the market.

Prices also saw some adjustment this month easing slightly relative to May’s levels. This was mostly due to adjustments in the North East, East, North West, North and South East districts of the city. However, with a benchmark price of $581,600, prices in Calgary remain nearly 13 per cent higher than levels reported last year.

Unlike the detached and semi-detached sector, row sales activity improved and reached a new record high for the month of June. The row market tends to offer a more affordable option for consumers compared to both semi-detached and detached homes. While new listings did improve relative to levels recorded last year, it was not enough to offset the gains in sales. As a result, inventories trended down and the months of supply remained relatively tight at one and a half months.

The benchmark price still recorded some modest gains this month, but the pace of growth slowed down significantly compared to earlier in the year. Overall, the benchmark price reached $363,700, nearly 16 per cent higher than last year.

While apartment condominium sales continued to slow from record levels reported earlier in the year, sales were still over 31 per cent higher than levels reported last year. This in part was possible due to the recent boost in new listings. At the same time, the boost in new listings did help take some of the supply pressure off this market as the sales-to-new-listings ratio eased to 62 per cent and the months of supply pushed up to nearly three months.

The shift to more balanced conditions is also helping slow the pace of price growth in this market, but not completely disrupt it. The benchmark price in June reached $277,400, nearly one per cent higher than last month and 10 per cent higher than last year’s levels. Despite these gains, prices continued to remain below 2014 highs.

Sales in June continued to ease from levels reported earlier in the year and levels achieved last year. However, the decline was not enough to offset earlier gains as year-to-date sales remain over 24 per cent above last year’s levels. While new listings did improve compared to last year, levels were not enough to significantly alter the tight market conditions in Airdrie. The sales-to-new-listings ratio remained relatively tight at 81 per cent and the months of supply, while higher than earlier in the year, pushed just slightly above one month.

Earlier in the year, Airdrie reported some of the highest monthly price gains ever seen in the market, so as interest rates rise and consumers take a step back to reevaluate conditions, it is not a surprise that we are seeing some adjustments in price. While prices have trended down for the past two months, they remain over 22 per cent higher than levels reported last year.

Easing sales this month contributed to year-to-date sales of 735 units, just slightly higher than levels reported last year. So far this year, the growth in new listings has outpaced the growth in sales and it has helped push up inventory levels relative to what was available in the market earlier in the year. This also helped push the months of supply back above one month, something that has not happened since October of last year.

While conditions remain far from balanced, the slight shift has taken some of the pressure off home prices which reported strong monthly gains earlier in the year. The benchmark price in June rose to $522,600, a slight gain over last month and nearly 18 per cent higher than prices recorded last year.

Sales activity remained relatively stable this month supporting year-to-date sales of 544 units, just slightly higher than levels reported last year. At the same time, new listings have also remained relatively consistent with last year’s levels. This is leaving the market to continue to favour the buyer with one month of supply and a sales-to-new listings ratio of 80 per cent.

Despite tight conditions, there was a modest pull back in the monthly price. However, with a benchmark price of $556,200, prices remain nearly 17 per cent higher than levels reported last year.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Calgary housing market sees shifts Housing activity continues to move away from the extreme sellers’ ...

Supply levels improve, taking some pressure off prices With the busy spring market behind us, we are ...